find it here

Plan Your Trip to Belmont County

Whether you are vacationing with family or on a business trip, we offer many unique shops, restaurants, hotels and more. Enjoy our friendly, relaxed atmosphere. Enjoy our beautiful Belmont County, Ohio.

get outside

Explore Belmont County

What's Happening in Belmont County

Upcoming Events

May 11 @ 9:00 am - 10:00 am

67800 Mall Rd

St. Clairsville,

OH

43950

United States

+ Google Map

Walk with a Doc

Sponsored by Trinity Health System. Bring a friend or the kids and walk with a Doc! Sign up to be

June 8 @ 9:00 am - 10:00 am

67800 Mall Rd

St. Clairsville,

OH

43950

United States

+ Google Map

Walk with a Doc

Sponsored by Trinity Health System. Bring a friend or the kids and walk with a Doc! Sign up to be

July 13 @ 9:00 am - 10:00 am

67800 Mall Rd

St. Clairsville,

OH

43950

United States

+ Google Map

Walk with a Doc

Sponsored by Trinity Health System. Bring a friend or the kids and walk with a Doc! Sign up to be

blog & articles

Featured Stories

April 18, 2024Haley McFarland

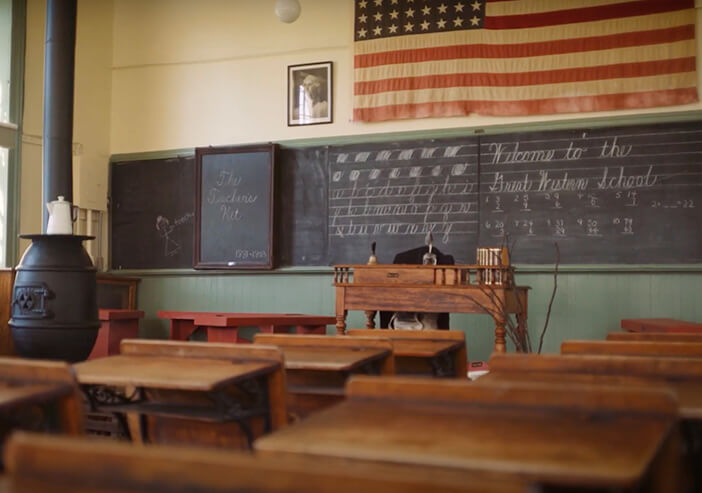

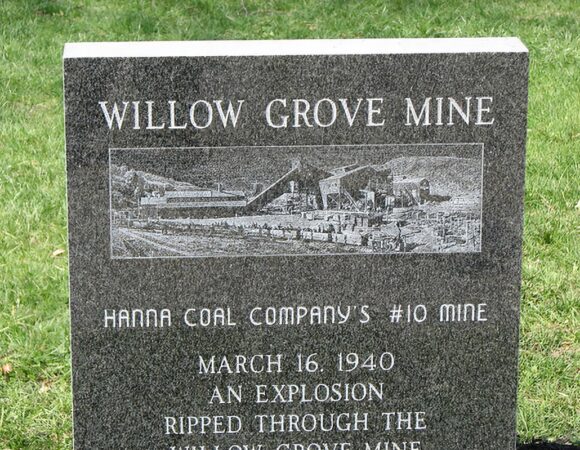

Every Mile Tells a Story Along The Belmont County Heritage Trail / Rubberneck Tour

March 25, 2024Haley McFarland

Experience the Solar Eclipse at 97% totality in Belmont County!

January 8, 2024Belmont County Tourism

Belmont County Tourism GAP Grant Applications Available

Belmont County Bigfoot GeoTour

Believe in the unseen! Discover the mystery, embrace the adventure and join us on an epic quest to find Bigfoot...themed geocache containers, of course!

Over 20 Caches in Belmont County

Earn a Belmont County Bigfoot geocoin by finding 20 of the hidden caches.

Begin Your Journey

Download the Geocaching App and get started today!

stay updated

Sign Up Today

Sign up for our newsletter to learn more about upcoming events, news in Belmont County, and exciting offerings.